Content

In the same way, Negative Stockholder’s Equity represents the weak financial health of the company. The primary function of stockholder’s equity is to evaluate the worth of a company and whether a company is a safe or risky investment. Beyond that, we can take a look at a company’s balance sheet to see their liabilities and stockholder’s equity to determine how they are performing statement of stockholders equity as a business and where they spend their money. There are numerous ways to use the information on a balance sheet to gain further information on a company’s financial management, and stockholder’s equity is but one in a long list. Shareholder equity, also called stockholder equity, is the difference between a company’s assets and liabilities on their balance sheet.

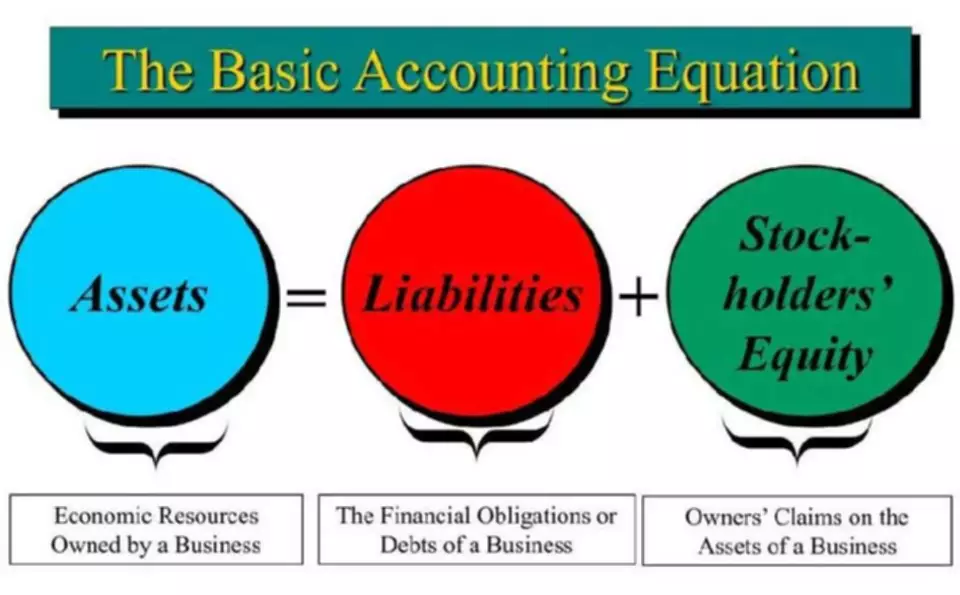

And, the amount can change as the company experiences gains and losses from selling shares. Different accounts appear in the equity section of your balance sheet. And, your liabilities and equity must equal your assets on your balance sheet. Stockholders’ equity, also known as shareholders’ equity, is the amount of assets given to shareholders after deducting liabilities. Stockholder’s Equity is an accounting term and refers to assets created by the company after paying off all of its debts. If a company has assets equal to $20,000 and liabilities equal to $12,000, then their stockholder’s equity is equal to $8,000.

Employee stock option vs. warrant?

The stockholders’ equity subtotal is located in the bottom half of the balance sheet. A company’s shareholder equity balance does not determine the price at which investors can sell its stock. Other relevant factors include the prospects and risks of its business, its access to necessary credit, and the difficulty of locating a buyer. Advocates of this method have included Benjamin Graham, Philip Fisher and Warren Buffett. An equity investment will never have a negative market value (i.e. become a liability) even if the firm has a shareholder deficit, because the deficit is not the owners’ responsibility. When you take all of the company’s assets and subtract the liabilities, what remains is the equity.

Let’s say you start a lawn care business and invest $500 of your own cash and spend $1,500 for lawnmowers for a total investment of $2,000. If you do not incorporate, your business is a sole proprietorship. To form a corporation, a business needs to file paperwork called articles of incorporation (and pay a fee) with the state in which it will be operating.

Example of Stockholders’ Equity

Information regarding the par value, authorized shares, issued shares, and outstanding shares must be disclosed for each type of stock. If a company has preferred stock, it is listed first in the stockholders’ equity section due to its preference in dividends and during liquidation. The stockholders’ equity, also known as shareholders’ equity, represents the residual amount that the business owners would receive after all the assets are liquidated and all the debts are paid. Shareholder equity is also known as the book value of the company and is derived from two main sources, the money invested in the business and the retained earnings.